Hindustan Zinc delivered strong performances from all our underground mines and many benchmarks in operational and financial performances were set during the year.

Economic Value Generated and Distributed

Crores

| |

|

| 2017-18 |

2016-17 |

| Revenue from operations (including excise duty) |

22,521 |

18,798 |

| Other income |

1,751 |

2,474 |

| Employees' wages and benefits |

776 |

722 |

| Operating costs |

6,298 |

6,763 |

| Payment to providers of capital |

3,663 |

12,624 |

| Payment to government (Income Tax, Royalty, etc.) |

3,769 |

6,250 |

| Community Investments |

92 |

49 |

| Economic Value Retained |

9,674 |

(5,136) |

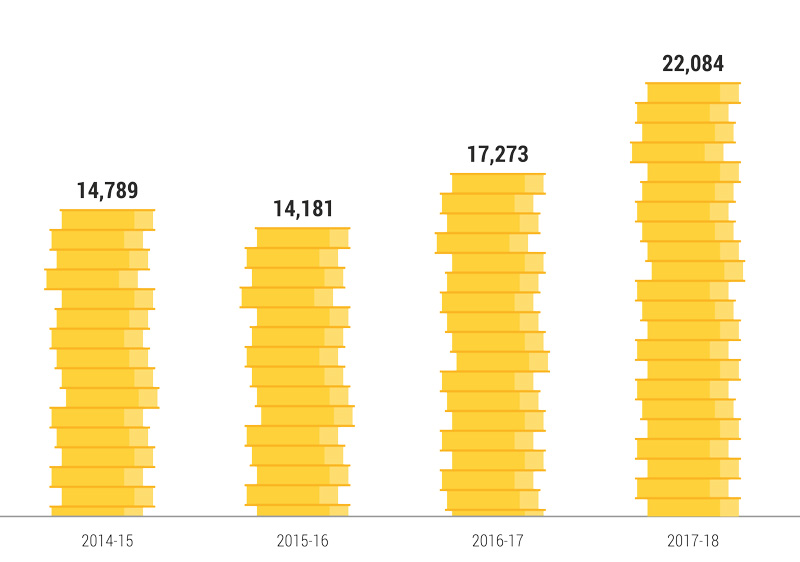

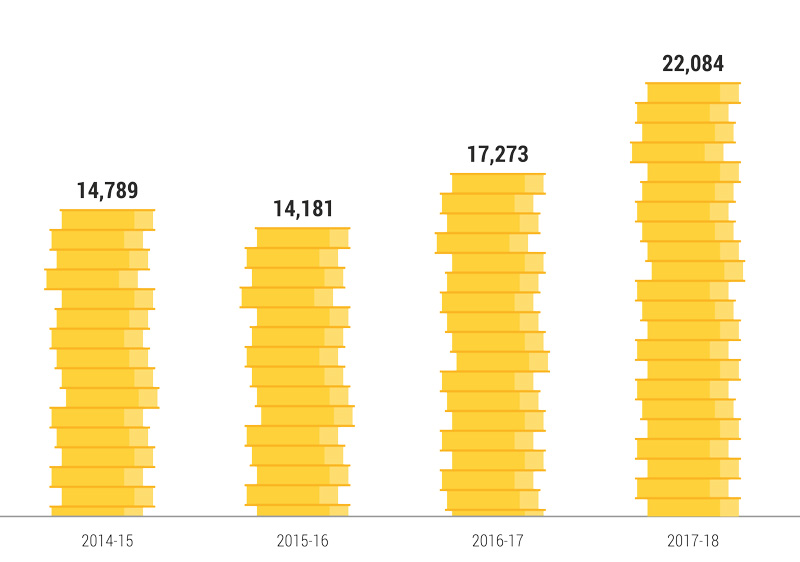

Revenue from Operations

(net of excise duty)

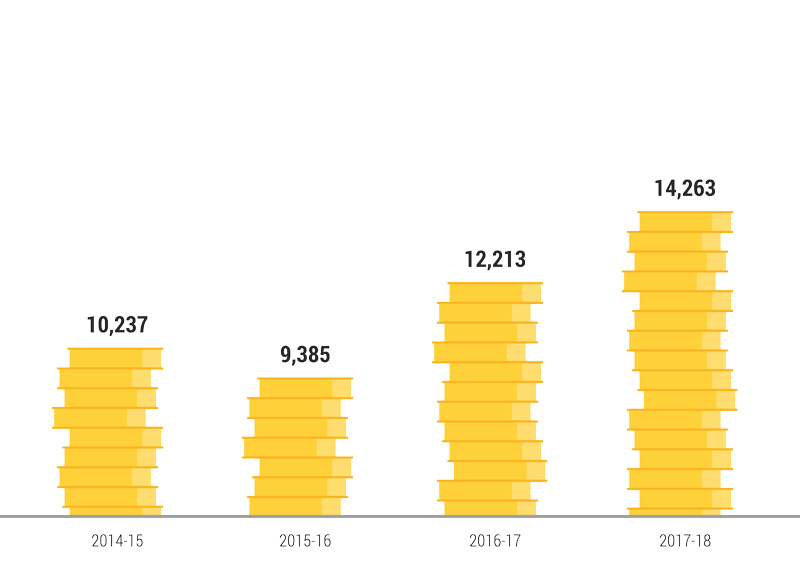

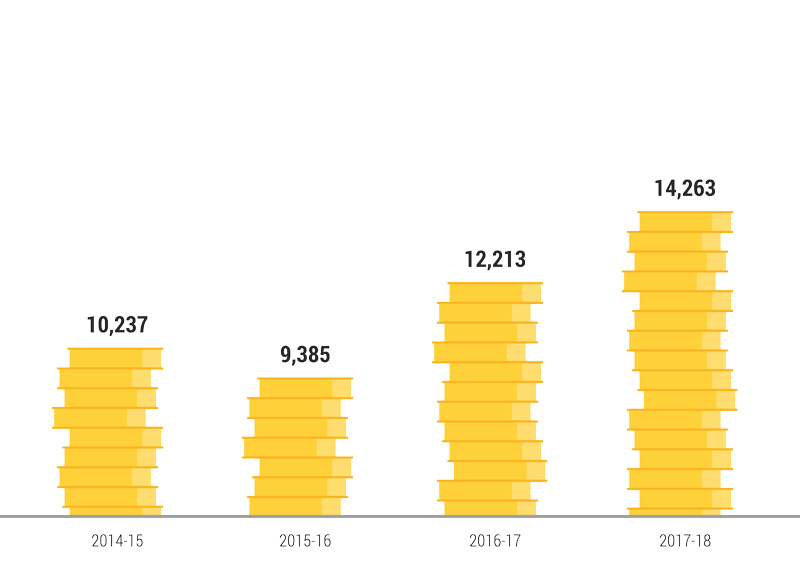

Profit before dep, int & tax

in INR crores

Profit after tax

in INR crores

Earnings Per Share

in INR

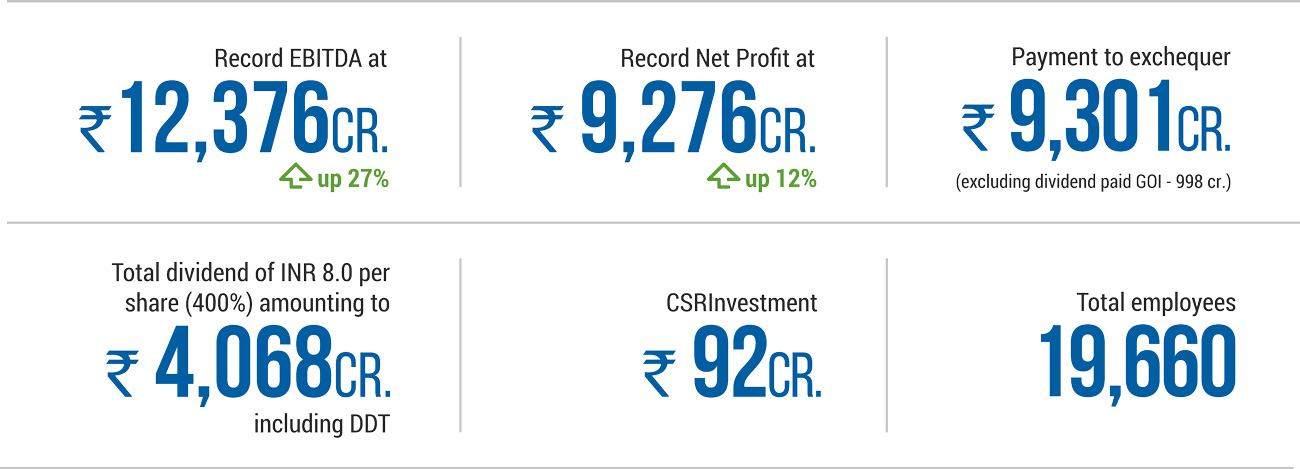

In FY 2017-18, our net revenue stood at INR 22,084 crore compared with INR 17,273 crores in FY 2016-17 - a growth of around 27%. EBITDA for FY 2017-18 improved to INR 12,376 crore, an all-time high of 27% over previous year.

We continued our robust performance setting a new record of 960kt of zinc & lead metal and

558 MT of silver, delivering growth of 19% and 23% respectively from last year. At 947kt, mined metal production was also at an all-time high. We are targeting another record year of production in FY 2019, in line with our expectation of delivering 1.2 million MT in FY 2020.

The Board declared dividend of 400% amounting to INR 4,068 crore including dividend distribution tax during the year. The EPS for the year was INR 21.95 per share as compared to INR 19.68 per share in FY 2017.

During the year, we contributed INR 9,301 crore to the Government treasury through royalties, taxes and dividends, which is 42% of our revenues.

The journey towards 1.2 million MT production that started in 2013 is now in its final stages and

expected to be achieved in FY 2020. Our strategic vision is to grow our output to 1.5 million MT per annum and our silver portfolio to 1,500 MT.

CRISIL has reaffirmed the long-term rating of AAA/Stable and short-term rating of A1+ to Hindustan Zinc. The financial risk profile is driven by our sustained strong liquidity and conservative capital structure as well as integrated operations, highly competitive cost position and high-grade reserves.

We follow a conservative investment policy and invest in high quality debt instruments. As on March 31, 2018, our cash, and cash equivalent, was INR 20,395 crore invested in high quality debt instruments and the portfolio is rated “Tier –1”, implying highest safety by CRISIL.

During the year, Hindustan Zinc paid off INR 8,000 crore of short term commercial paper raised in March 2017 to meet the special interim dividend funding requirement.